In the high-stakes world of trading, the processing speed of your trading computer can be a game-changer. This guide delves into the pivotal role of processing speed in trading performance, examining how it influences every aspect of your trading experience. From executing trades to analyzing complex market data, the processor’s speed is crucial. Check out the fastest processors in our builds, designed to give traders the edge they need in today’s rapidly evolving financial markets.

Understanding Processing Speed in Computers

Processing speed in a trading computer, primarily governed by the CPU, dictates how quickly the system can execute tasks and process information. It’s the driving force behind the computer’s ability to handle real-time market analysis and execute trades without delay. Understanding the nuances of clock speed, core count, and threads is crucial for traders. A higher clock speed and more cores translate to better performance, allowing traders to capitalize on market movements swiftly and efficiently.

Why Processing Speed Matters in Trading

Processing speed is vital in trading, where milliseconds can mean the difference between profit and loss. A trading computer with a fast processor ensures swift execution of trades, essential in fast-moving markets. For day traders and those engaged in high-frequency trading, where decisions are made in fractions of a second, a high-speed CPU can significantly impact the success of their strategies. Quick processing allows for rapid analysis and reaction to market changes, offering a distinct advantage.

Processing Speed and Its Impact on Different Types of Trading

Day Trading

In day trading, where the market can shift in seconds, a high-speed trading computer can be the difference between a successful trade and a missed opportunity. Fast processors enable traders to quickly analyze and react to real-time market data, making them indispensable for day traders.

Swing Trading

Swing traders, although they operate on a slightly longer timeframe than day traders, still benefit significantly from a fast processor. Quick data processing allows for timely decision-making in executing trades at optimal moments.

Long-Term Investing

For long-term investors, processing speed plays a more subdued but still relevant role. A faster trading computer can quickly handle data analysis, portfolio management, and occasional trade executions, making it a valuable asset even for long-term strategies.

Balancing Cost and Performance: Is Faster Always Better?

While a high-speed processor in a trading computer is advantageous, it comes with increased costs. Traders need to balance the performance benefits with the financial investment. In many cases, the improved efficiency and potential gains in trading can justify the higher cost of a faster CPU. However, it’s important for each trader to evaluate their specific needs and trading style to determine if the extra investment aligns with their trading objectives and budget.

Upgrading Your Trading Setup for Better Processing Speed

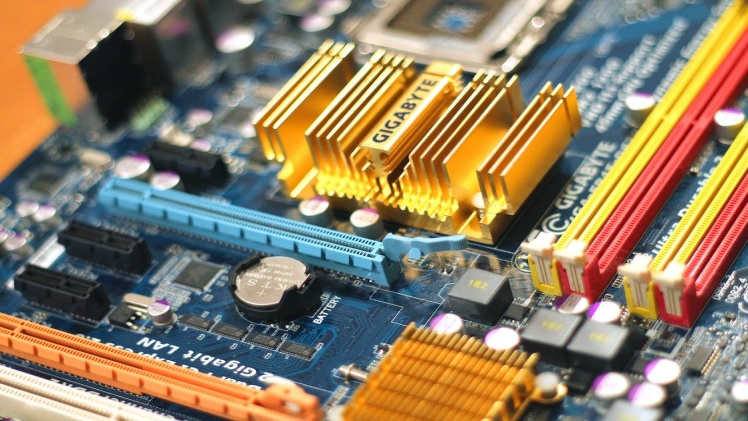

Upgrading your trading computer for improved processing speed involves careful consideration of CPU options that align with your trading requirements. Look for processors with higher clock speeds and more cores that fit within your budget. Remember, upgrading the CPU might also necessitate compatible motherboards and adequate cooling solutions. It’s about creating a harmonious and efficient system where every component complements the others, enhancing your overall trading performance.

● Choosing the Right Processor: Look for CPUs with higher clock speeds and more cores. Top contenders often include the latest offerings from Intel’s Core series or AMD’s Ryzen series. These processors are designed to handle intense multitasking and complex calculations, common in trading scenarios.

● Compatibility Check: Ensure that your chosen CPU is compatible with your motherboard. An incompatible CPU requires a motherboard upgrade, adding to the cost.

● Adequate Cooling System: High-performance CPUs generate more heat. Consider upgrading your cooling system to a more efficient one, like liquid cooling, to maintain optimal temperatures and prevent thermal throttling.

● RAM Upgrade: Alongside the CPU, consider upgrading your RAM. More RAM allows your trading computer to handle more data simultaneously, which is beneficial for running multiple trading applications or extensive data analysis.

● Balancing Cost and Performance: Assess the cost of the upgrade versus the expected performance boost. While a high-end CPU offers the best performance, mid-range processors can also provide significant improvements without the hefty price tag.

● Seek Professional Advice: If you’re not tech-savvy, consult with a professional to ensure that your upgrades are compatible and worthwhile. They can also assist with the actual upgrade process, ensuring everything is installed and configured correctly.

Upgrading your trading setup for better processing speed involves a careful balance between performance gains and investment. By selecting the right components and ensuring compatibility, you can create a more efficient trading environment that keeps up with the demands of modern trading.

Conclusion

The impact of processing speed on trading performance is undeniable. A fast processor in your trading computer can dramatically improve your ability to trade effectively, capitalizing on opportunities as they arise. Whether you’re involved in day trading, swing trading, or long-term investing, the right processing speed can make a significant difference in your trading outcomes. Assess your trading strategy and consider if a processing speed upgrade could provide the competitive edge you seek. In the fast-paced world of trading, every second counts, and a faster processor could be the key to unlocking your full trading potential.